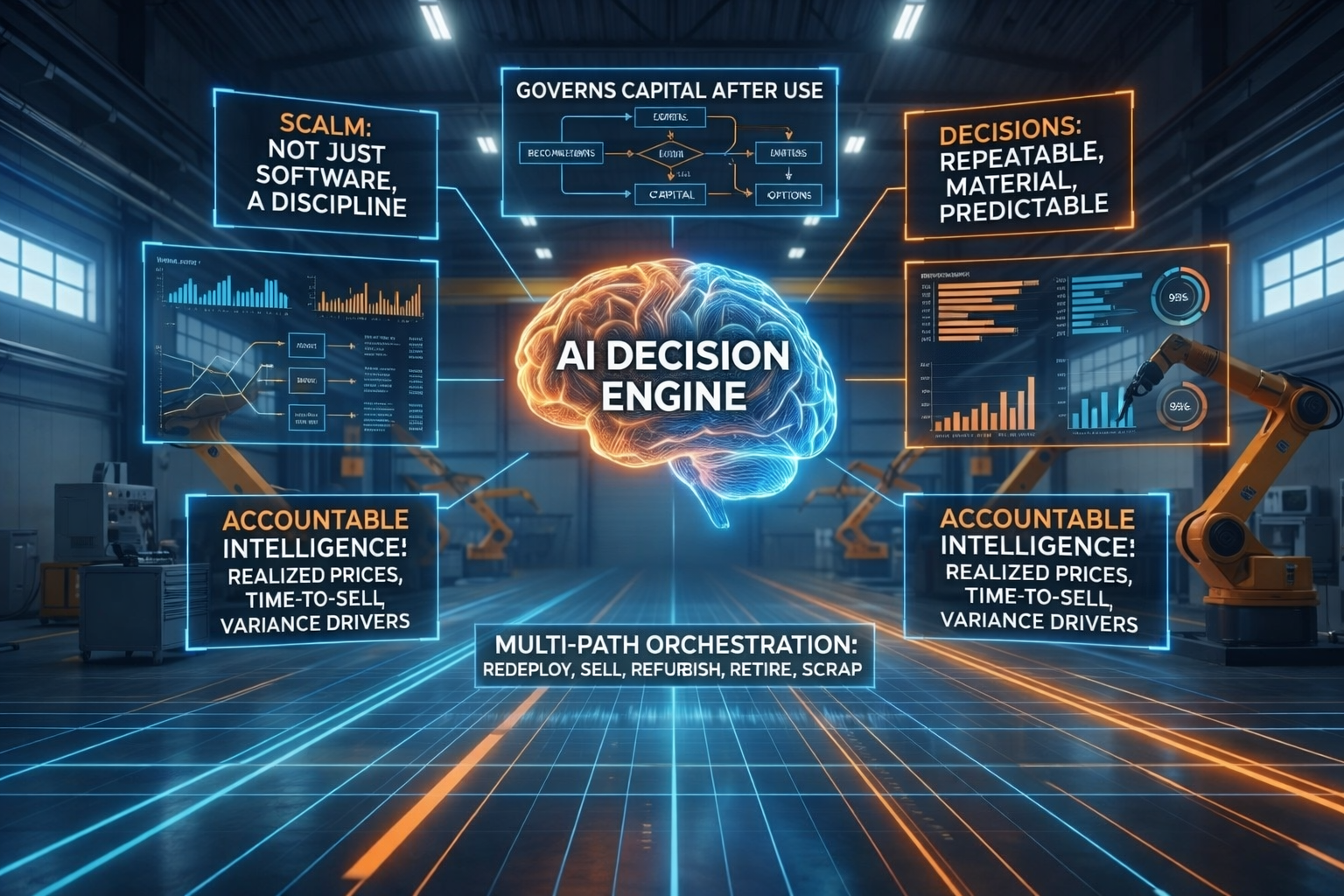

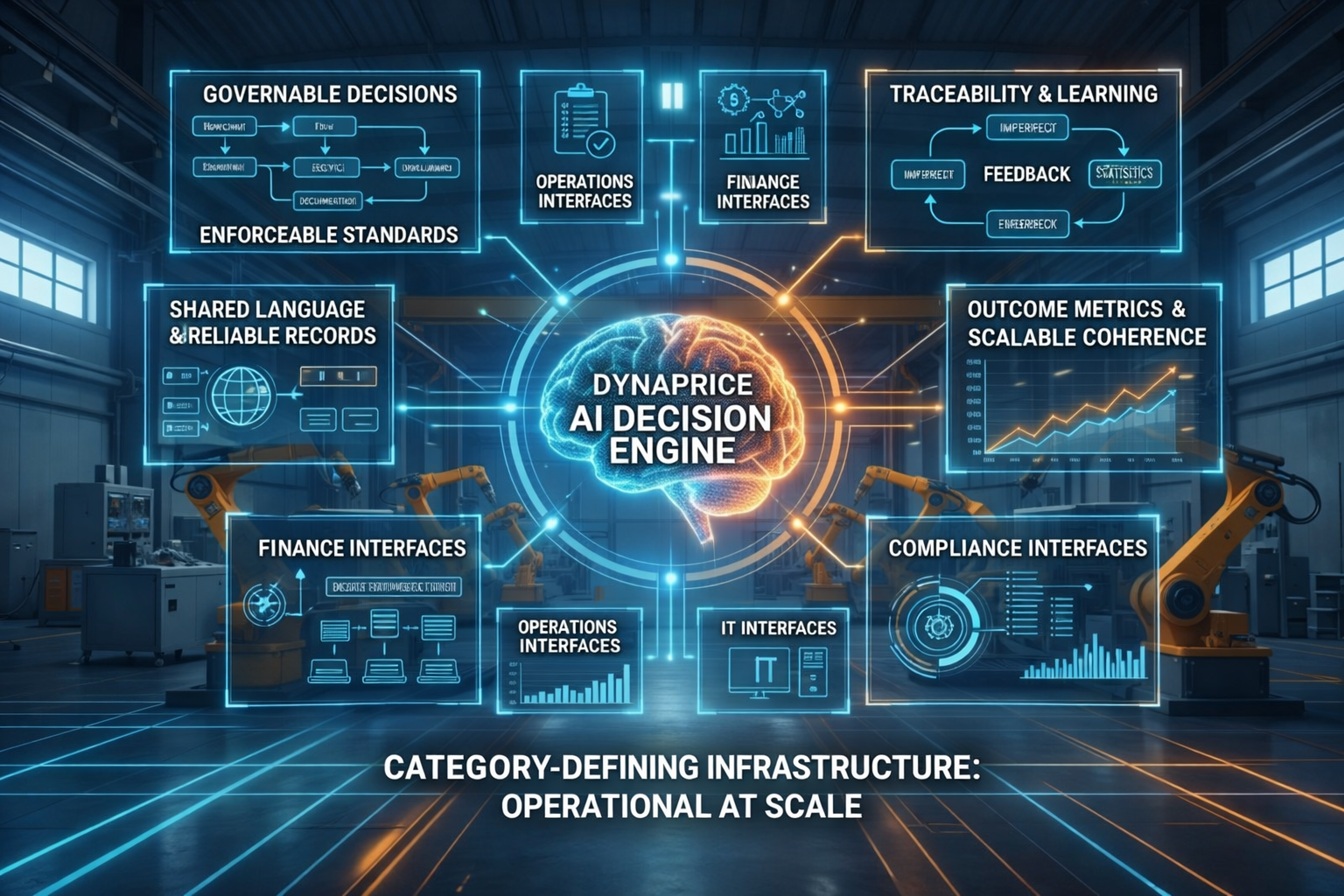

Surplus Capital Asset Lifecycle Management (SCALM): The Definitive Guide to Governing Surplus Capital Assets in the AI Era

Learn why surplus capital assets historically escaped governance and how SCALM is emerging to transform them into governed capital using AI‑driven, execution‑anchored decision intelligence.